For small businesses, efficient expense management is vital to maintaining a healthy financial outlook and ensuring smooth operations. However, the traditional manual approach to expense management can be time-consuming and prone to errors, diverting valuable resources from core business activities. The good news is that advancements in technology offer an effective solution: digitization & automation.

In this blog post, we present a 5-step action plan specifically tailored for small businesses to automate their expense management using virtual prepaid company cards and an expense management solution.

Embrace automation to simplify processes, save time, and enhance financial control.

Step 1: Assess Your Expense Management Needs

Begin by understanding your small business’s unique expense management requirements and current workflow. Evaluate existing pain points, such as manual data entry, delayed approvals, or lost receipts. By identifying these challenges, you can better address them with the right automation tools.

Use this workflow analysis to help you with this step.

Step 2: Review the Current Employee Expense Policy

The cornerstone of good expense management is good policy. Identify areas in your current policy that need to be updated or improved like late reimbursement of expenses paid by employees, incorrect employee expense reports or expense fraud and whether these issues are caused partially by an effective policy in place. Include all relevant stakeholders in this process to ensure a smooth transition.

Step 3: Choose the Right Expense Management Solution

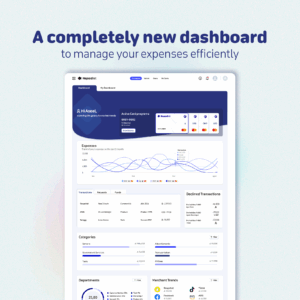

Selecting a suitable expense management solution is crucial for seamless automation. Opt for platforms that are user-friendly, cost-effective, and designed to cater to the needs of small businesses. Look for features like real-time expense capture, automated categorization, integration with accounting software, multi-currency support, and customized approvals.

Book your demo with Nqoodlet and see how this works.

Step 4: Issue Prepaid Company Cards

Introduce prepaid company cards to your employees and encourage them to use the card for all business-related expenses. These cards serve as a powerful tool for managing business expenses effectively. They enable you to set spending limits, monitor transactions in real-time, and maintain a clear separation between personal and business spending. Moreover, this is a great wait to empower your employees and allow them to focus on core tasks that are critical versus admin hassles.

Step 5: Analyze Insights and Optimize Spending

Leverage the data and insights provided by your expense management solution. Use the information to analyze spending patterns, identify cost-saving opportunities, and optimize budget allocation. Having a clear understanding of your company’s expenses will enable you to make informed financial decisions and drive growth.

Conclusion

Automating expense management is a game-changer for small businesses seeking to streamline processes and stay ahead in a competitive market. By following this 6-step guide and embracing virtual prepaid company cards alongside an expense management solution, your small business can save valuable time, enhance financial visibility, and ensure better control over expenses. Embrace automation and empower your small business to focus on what truly matters – growth, innovation, and success.