You might wonder if there’s still a place for physical company payment cards, especially as digital wallets and tap-to-pay technology continue to surge in popularity. The answer is a resounding yes! While virtual cards offer undeniable convenience, company payment cards in their plastic form come with unique benefits that can’t be ignored.

Essential Uses for Physical Cards

The versatility of plastic cards extends across various use cases, making them indispensable tools for businesses of all sizes. Beyond security and control, physical company cards offer functionalities virtual cards can’t replicate:

- Point-of-Sale Transactions: Not all vendors have adopted tap-to-pay technology. A physical card ensures employees can make purchases even at smaller shops or those with outdated systems. This reduces the need to carry cash and provides an alternative to petty cash payments.

- Cash Withdrawals: Certain situations, like travel or unforeseen expenses, may require accessing cash. Company cards offer a secure way to withdraw funds when needed.

- International Transactions: While some virtual cards work internationally, others encounter limitations. Physical cards often provide broader acceptance across borders, especially in regions with less developed digital infrastructure. They offer currency conversion services and purchase protection benefits, simplifying cross-border transactions.

Learn how to get your company a USD company card. Book your demo!

CaaS FinTechs: A Game-Changer for Company Cards

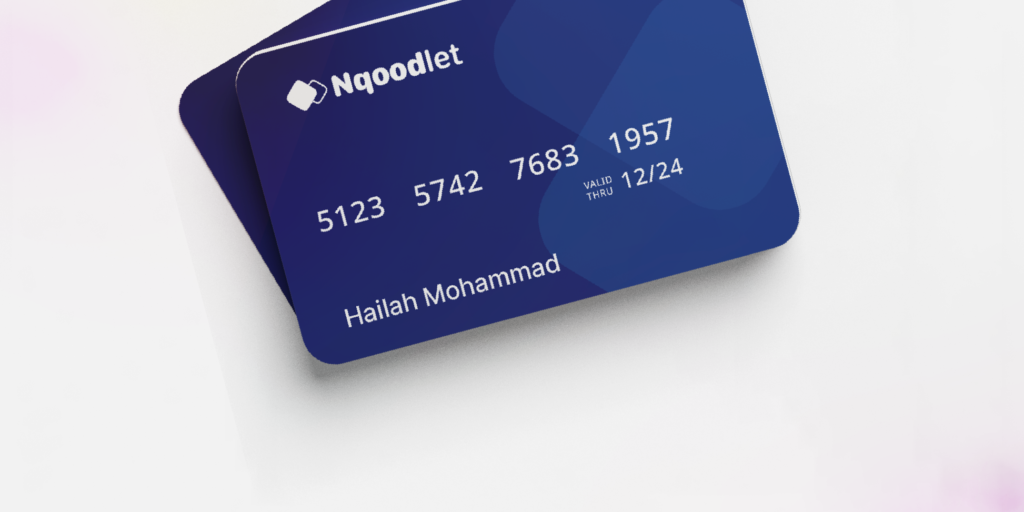

Now, let’s differentiate company payment cards issued by CaaS (Card-as-a-Service) fintech companies from traditional bank-issued cards. Nqoodlet, for example, offers a more streamlined and cost-effective approach. Here’s what sets it apart:

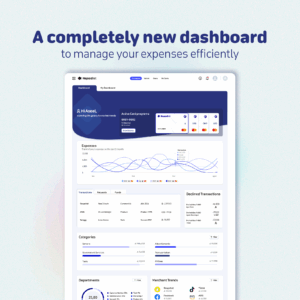

- Customization: CaaS fintechs offer greater flexibility in tailoring cards to specific needs. Merchant restrictions, and real-time expense tracking features can be easily configured for each card.

- Speed and Efficiency: Say goodbye to lengthy application processes and approvals. CaaS platforms allow for quick issuance of cards, often within minutes, eliminating delays and frustrations.

- Integrated Data and Expense Management: CaaS solutions seamlessly integrate spending data with accounting software, simplifying expense reporting and reconciliation. Businesses gain valuable insights into spending patterns, allowing for better budgeting and cost control.

The Ideal Duo: Physical and Virtual Cards Working Together

For a well-rounded approach to business payments, consider combining physical and virtual cards. Physical cards offer continued utility at traditional vendors, while virtual cards provide unmatched convenience and security for online transactions and recurring expenses. This strategic mix empowers businesses to navigate diverse payment situations with optimal control and efficiency.

CaaS fintech platforms, like Nqoodlet, empower companies to create a dynamic payment ecosystem that caters to their unique needs. With the right tools and strategies, businesses can ensure efficient and secure spending for their teams, regardless of their location or transaction type.