The days of drowning in paper receipts and wrangling expense reports are numbered. Businesses are embracing a new era of streamlined expense management – and it all starts with virtual payment cards.

These aren’t just the average corporate credit cards. Virtual cards are designed for the digital age, offering unmatched versatility, real-time expense tracking, and complete control over spending. This blog will dive deep into how virtual cards can revolutionize the way your business handles expenses, freeing you from the shackles of outdated systems.

The use cases for virtual cards are diverse and versatile, making them invaluable tools for businesses of all sizes and industries. Here are some key scenarios where virtual cards shine:

- Online Purchases: Virtual cards are perfect for online transactions, including subscriptions and e-commerce purchases. Their secure encryption minimizes fraud risks, offering peace of mind to both businesses and vendors.

- Subscription Management: Virtual cards streamline subscription management for various services like software, cloud storage, and SaaS tools. You can assign each vendor a unique card, facilitating easy tracking, monitoring, and cancellation of subscriptions.

- Travel Expenses: Virtual cards provide a hassle-free solution for managing travel expenses for companies with frequent business travelers. Employees can book flights, hotels, and rental cars online, eliminating reimbursement processes and reducing administrative burdens.

- Remote Workforce: Virtual cards empower businesses to offer secure payment options to remote employees. Whether purchasing office supplies or client gifts, virtual cards provide flexibility without the need for physical cards or cash.

- Budget Control and Oversight: Virtual cards offer businesses precise spending control by allowing administrators to set spending limits, transaction categories, and usage restrictions for each card. This level of control enhances budget management, prevents overspending, and enables real-time expense monitoring.

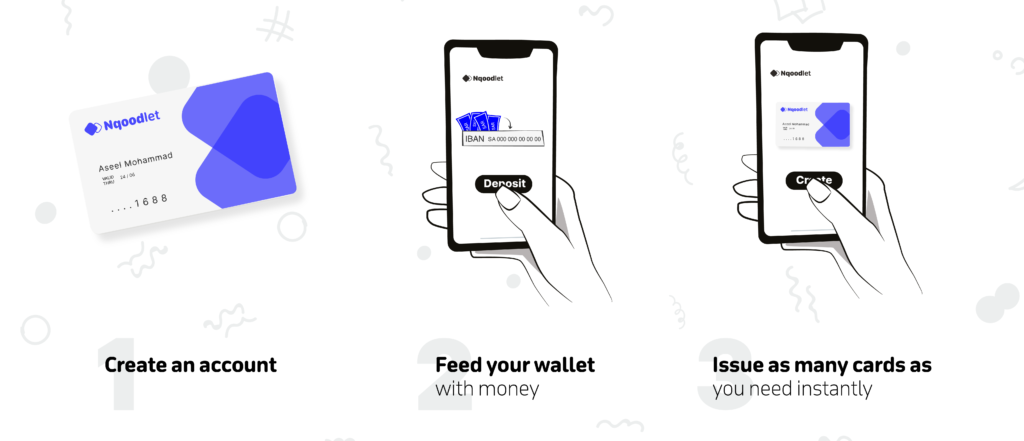

The Number One Company Card in Saudi. How to get it?

Many local businesses trust the Nqoodlet card with their payments. It’s simple, effective, and solves a real problem. With Nqoodlet’s expense management platform, you have the power to issue your own cards effortlessly and immediately. Choose between SAR and USD cards, with competitive currency exchange fees tailored to your needs. Here’s all you need to do:

Want to learn more? Book your free demo!

The Takeaway

Virtual company cards have become an essential tool for effective expense management. Currently, there is no alternative in the market that provides the same level of control and versatility. With just one card, you can eliminate hours of paperwork, slow processes, and outdated approval workflows.