Spreadsheets have long been a trusted companion for managing business finances. Their versatility, ease of use, and affordability have made them an attractive choice for many entrepreneurs. If you’re in business finance, you must be using spreadsheets as an integral part of your job. The question is, should you entirely rely on spreadsheets for managing the financial data of your company?

It’s essential to acknowledge that while spreadsheets have their merits, they are not without their limitations. In this blog, we will explore why relying on spreadsheets entirely may not always be the ideal solution for managing business finances. Additionally, we’ll consider alternative tools that can address some of the limitations of spreadsheets.

Reasons to Use Spreadsheets

A trusted tool in business finances, many find spreadsheets to be very useful. Before we consider their limitations, let us first acknowledge why spreadsheets are such a good tool for many finance professionals.

- Versatility: Spreadsheets are highly adaptable and can be customized to suit various financial needs, from budgeting to forecasting.

- Ease of Use: Their user-friendly interface allows individuals with basic Excel skills to create and manage financial documents effectively.

- Affordability: Spreadsheets are cost-effective, making them accessible for businesses with limited budgets.

The Limitations of Spreadsheets

While spreadsheets are versatile, they may not always be the best choice for managing complex or rapidly growing business finances.

Here are some limitations to consider:

- Error-Prone: Manual data entry and formula creation can lead to errors. A single mistake in a complex financial model can have significant consequences.

- Limited Collaboration: Collaborating on spreadsheets can be challenging, especially when multiple team members need access simultaneously. Version control and data consistency can become issues.

- Lack of Automation: Spreadsheets require manual updates and calculations. This can be time-consuming and may not scale well as your business grows. If you can automate a certain workflow, then it is better to make that upgrade and forget about manual work.

- Data Security: Spreadsheets can lack robust security features, making them vulnerable to data breaches or unauthorized access.

Alternatives to Spreadsheets

For businesses seeking more advanced financial management solutions, alternatives to spreadsheets are available:

- Accounting Software: Dedicated accounting software like QuickBooks, Xero, or FreshBooks offer features for managing finances, automating calculations, and improving collaboration.

- Enterprise Resource Planning (ERP) Systems: ERPs like SAP or Oracle provide comprehensive financial management capabilities, integrating financial data with other aspects of your business.

- Cloud-Based Financial Management Tools: Cloud-based platforms like NetSuite or Intacct offer scalability, data security, and collaboration features that can address many spreadsheet limitations.

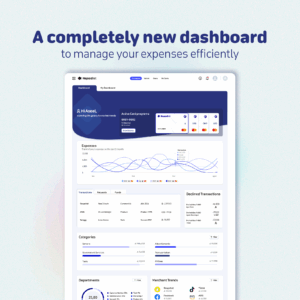

- Expense Management Solutions: Platforms like Nqoodlet specialize in expense management, simplifying the tracking of business expenses, automating workflows, and enhancing compliance. Most importantly, they offer businesses a secure method of paying for expenses using a multi-currency prepaid company card.

The Takeaway

As businesses grow and financial complexity increases, the limitations of spreadsheets can become more apparent. It’s crucial to evaluate your business’s specific needs and consider alternative solutions that may provide better accuracy, automation, collaboration, and data security. While spreadsheets have their place, exploring advanced financial management tools can help your business navigate its financial journey more effectively.