We’re proud to announce that Nqoodlet has successfully closed a $3 million seed funding round, led by Waad Investment, with participation from OmanTel, 500 Sanabil Investment, Oqal, Seed Holding Company and several strategic angel investors who share our vision of building a more efficient and agile financial future across the region.

From day one, our mission has been clear: to simplify financial operations for small and medium-sized enterprises (SMEs) across Saudi Arabia and the broader MENA region. In a world where operational complexity continues to rise, we chose to build an integrated financial operating system that enables entrepreneurs to focus on growth—not on daily financial tasks.

Through this funding, Nqoodlet aims to accelerate its growth in the fintech sector by advancing product development, expanding its customer base, and strengthening its regional footprint. The company emphasized that the investment will play a pivotal role in supporting its strategic plans in the coming period, with a strong focus on innovation and delivering secure, practical financial solutions for startups and mid-sized businesses.

“We chose to lead Nqoodlet’s seed round because we believe they are not just building a product — they are building an entirely new future for financial technology. Under the leadership of Mohamed Milyani and Yara Ghouth, the Nqoodlet team has successfully transformed the everyday challenges faced by SMEs into smart, advanced, and easy-to-use solutions.

Their strong focus on product excellence, combined with their seamless integration of technology into financial operations, perfectly reflects the type of companies we seek to support. Today, Nqoodlet is on its way to becoming the leading innovator in the region, and we are excited to be part of this game-changing journey.”

— Yasser Alghamdi, Chief Investment Officer of Waad Investment

What’s Next for Nqoodlet?

This funding round marks a strategic milestone in our journey and will be channeled into three key pillars:

1. Product Development

We are expanding our suite of features to include:

Direct integrations with open banking systems

Automated tools for accounting and VAT

AI-powered financial analysis and planning systems

A tailored financial services platform for SME-specific needs

2. Infrastructure and Strategic Partnerships

We are strengthening our banking infrastructure and ecosystem through strategic partnerships with:

Banks and banking service providers

SME enablers and support entities

Telcoms and technology service providers

3. Team Growth

We are building a world-class team, focusing on:

Attracting top talent in tech, product, and user experience

Enhancing our support teams to deliver a more professional, responsive client experience

“SMEs here are not just underserved — they’ve been overlooked for too long. Nqoodlet is changing that. This funding gives us the rocket fuel to scale faster, go deeper with banks, and bring financial clarity to thousands of businesses who deserve better.”

— Mohamed Milyani, CEO & Co-founder of Nqoodlet

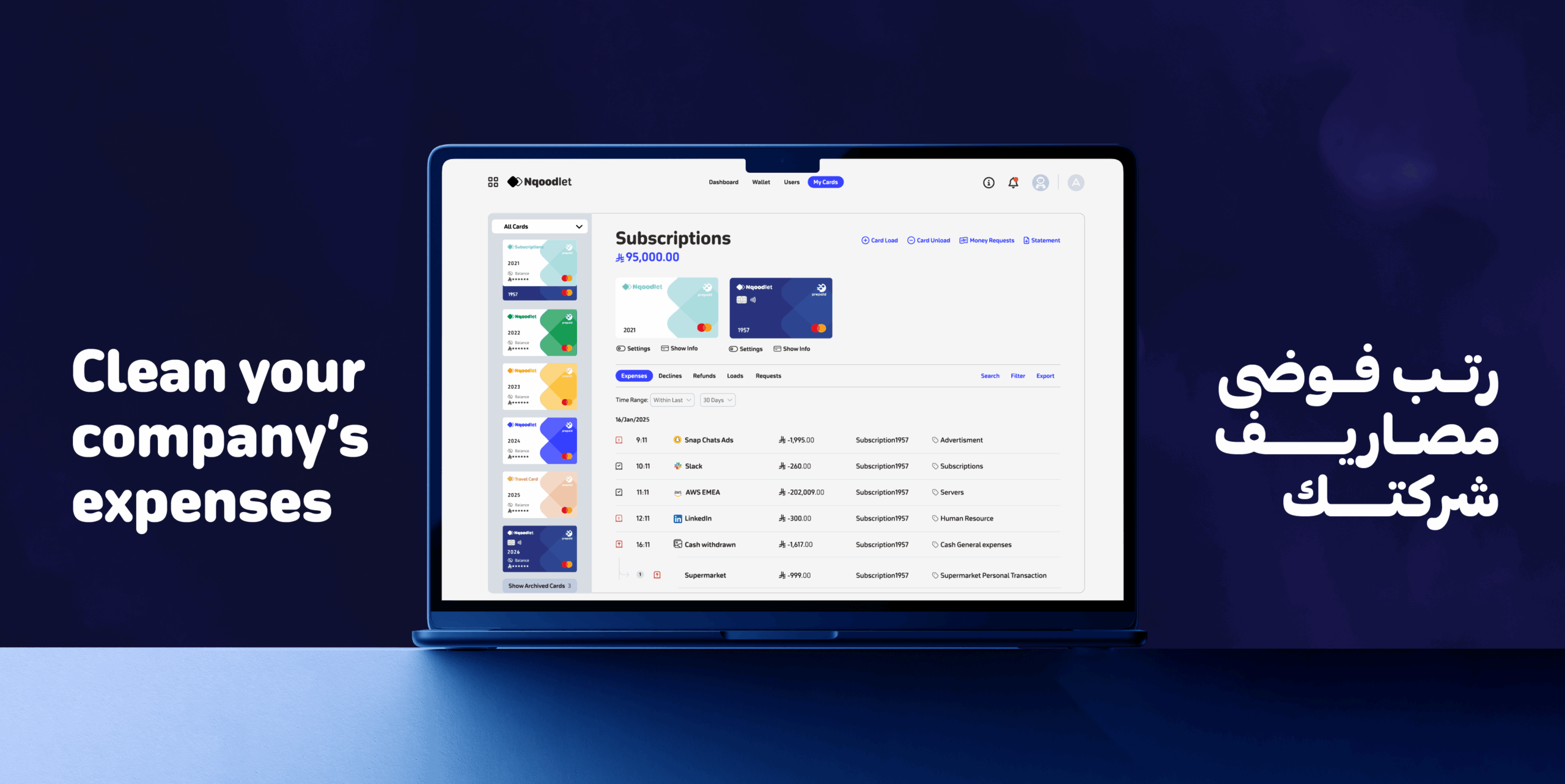

Nqoodlet’s The All In One platform delivers a powerful suite of services that includes:

Smart corporate cards with real-time spend control

Automated VAT filing and accounting

Open banking integrations

Tools for financial reporting and strategic planning

An open marketplace of high-quality services tailored to SME growth

By combining banking infrastructure, financial automation, and intelligent data analytics into a single platform, Nqoodlet enables businesses to move faster, gain more control, and reduce reliance on manual processes.

At Nqoodlet, we believe financial operations are the backbone of any business — the engine behind functionality, growth, and sustainability. That’s why we’ve built a true financial operating system for SMEs across the region, empowering them with:

Clarity — Transparent, real-time financial insights for smarter decisions

Control — Full visibility and precise accountability for every riyal spent

Efficiency — End-to-end automation for expense management, VAT submission, bookkeeping, and financial planning

Resilience — Built-in compliance, fraud protection, and proactive risk management

Strategic Growth — Financial governance that unlocks new horizons

“This isn’t just a funding round. It’s a statement: GCC is ready for the next generation of fintech, and we’re paving the way. We’re here to make sure every business — from the smallest startup to the fastest-scaling SME — has access to financial tools that are fast, intuitive, and built for growth.”

— Yara Ghouth, Co-founder of Nqoodlet

To date, we’ve empowered more than 600 SMEs, helping them save over 80 million SAR in operating costs through the power of automation and smart financial control.

This round is not the end — it’s the beginning of a bold new phase of scale, innovation, and lasting impact. We’re deeply grateful to everyone who believed in us: from our early customers and investors to our dedicated team who show up every day to build a platform that businesses can trust.

We believe the financial future of SMEs starts with digital infrastructure — and we’re here to lead that transformation.

Interested in improving how your company manages spending?

Contact us today to schedule a demo and explore the Nqoodlet platform💳💻