Quarter-end close is a crucial financial process for businesses, encompassing a range of activities aimed at ensuring the accuracy of financial records and reports for the previous quarter. It serves as a checkpoint, allowing you to assess your company’s financial health and make informed decisions for the upcoming quarter. This process includes reconciling accounts, reviewing financial statements, verifying tax compliance, and updating financial records.

For small businesses with limited accounting resources, quarter-end close can be challenging, but with careful planning and the right approach, it becomes a manageable task.

Here are some valuable steps to help you crush every month-end, quarter-end and even year-end close:

- Start Early: Begin the quarter-end closing process well in advance. Waiting until the last minute can lead to errors and stress. Set a timeline, mark it on your calendar, and stick to it.

- Organize Your Financial Data: Ensure that all your financial data is accurately recorded and organized throughout the quarter. This includes invoices, receipts, bank statements, and payroll records. Utilize accounting software to automate data entry as much as possible.

Tip: It takes up to 6 days for many businesses to finish month-end closing[i], a period that can be significantly longer for the quarter-end close if proper close is not maintained on monthly basis. A strong month-end close sets the foundation for a smooth and accurate quarter-end close (Checkout this checklist for smooth closing)

- Reconcile Accounts: Reconciliation is a critical step. Match your bank statements with your accounting records to identify any discrepancies. This will help in uncovering errors or fraudulent activities early on.

- Review Invoices and Expenses: Check for any unpaid invoices or unrecorded expenses. This can prevent surprises down the road and helps you manage cash flow effectively as well as keeping retrospective adjustments at a minimum.

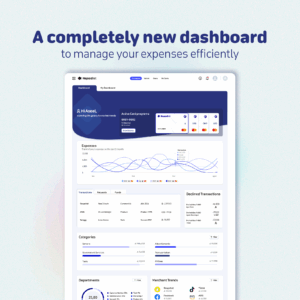

Tip: Consider integrating an expense management solution into your quarterly closing process. Nqoodlet offers a prepaid company card that simplifies expense tracking and management, allowing you to automate expense workflows, reduce the risk of errors, and ensure that your expenses are accurately recorded during the quarter. This can significantly streamline the quarter-end close process. Try it!

- Update Depreciation and Amortization: If your business uses depreciation or amortization for assets, make sure these calculations are up to date. This is crucial for accurate financial reporting.

- Verify Tax Compliance: Quarter-end is an excellent time to ensure your business is compliant with tax regulations. Make estimated tax payments and double-check any deductions or credits you may be eligible for.

Tip: Before finalizing your quarter-end close, perform a trial close to catch any last-minute issues. This will allow you to make corrections without affecting your official financial statements.

- Seek Professional Help: Consider consulting with an accountant or financial advisor, especially if your business has complex financials. Their expertise can be invaluable in ensuring accurate quarter-end close and financial compliance.

Takeaway

A well-organized and systematic quarter-end close process is essential for financial accuracy, compliance, and informed decision-making. Tailor this checklist to your specific business needs and industry requirements. Remember that a strong month-end close sets the foundation for a successful quarter-end close, so prioritize both processes to ensure financial stability and growth for your small business.

[i] https://www.highradius.com/resources/Blog/what-is-month-end-close-process/