Small businesses today rely on numerous online subscriptions to manage their operations efficiently. From software-as-a-service (SaaS) tools, Card-as-a-service (CaaS), to cloud-based storage platforms and more, these subscriptions can quickly add up and become a financial burden if not managed properly.

In this article, we will discuss some tips and strategies to help startups & small companies manage their online subscriptions effectively and avoid any cash leaks that may arise due to outdated or unnecessary subscriptions.

How to perfectly manage your business subscriptions?

- Take inventory of your subscriptions

The first step to managing your online subscriptions is to take stock of what you’re currently paying for. If you’re not using expense management or subscription management tools already, you can create a spreadsheet or document that lists all of your subscriptions, including the name of the service, the monthly or annual cost, and the renewal date. This will give you a clear picture of how much you’re spending and when your subscriptions need to be renewed.

- Prioritize your subscriptions

Once you have a list of your subscriptions, prioritize them based on their importance and usefulness to your business. Identify which subscriptions are essential and which ones you can do without. For instance, you may need a project management tool to manage your team’s tasks, but you may not need a premium social media management tool if you have a small social media presence.

- Negotiate better rates

If you’re paying for multiple subscriptions, consider negotiating with the service providers for better rates. Many SaaS companies offer discounts for annual subscriptions or for customers with multiple subscriptions. Contact your service providers and ask if they can offer you a better rate or a bundled package.

- Update your subscriptions

Make sure to keep your subscriptions up to date by regularly reviewing them and renewing them on time. An outdated subscription can lead to lost productivity and unnecessary expenses, as you may be paying for a service that you no longer use or need.

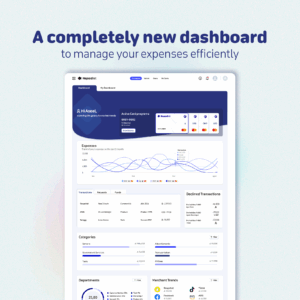

- Consider using an expense management tool

Expense Management solutions can help you manage your subscriptions more efficiently. These tools can streamline all your subscription-based payments, track your subscriptions, and provide you with insights into your subscription spending.

- Use corporate cards for payment (and pay in the same currency)

It can add a lot to your costs if you use a local currency credit card to make cross-border payments, especially when these are recurring payments. Look for a corporate card provider that offers multi-currency cards, most importantly USD, with an integrated expense management platform. This way, you’re able to manage your subscriptions from payment to reports.

Learn more about CaaS solutions here.

In conclusion, managing online subscriptions is an important aspect of financial management for small businesses. By using a corporate card with an expense management solution, you can consolidate all management tasks into one platform. Taking inventory of your subscriptions, prioritizing them, and updating them regularly will no longer be a taxing manual job. Using an expense management tool helps you manage your subscriptions more effectively and avoid any unnecessary expenses.