In most companies, employees need to pay some expenses as part of completing their tasks, which requires handling expense claims and paying reimbursement on a continuous basis. Many consider this process complicated and slow, especially given that each expense claim takes about 20 minutes to process, and eventually several claims may accumulate before the employee receives any reimbursement. Therefore, some companies are moving towards allocating fixed allowances as an alternative solution.

A fixed allowance policy may solve the issue of time and reimbursement, but other elements are considered when comparing both methods and selecting the best for your company.

To help you find the best way to manage your company’s expenses, we review the pros and cons of the fixed allowance and expense claims method in terms of its suitability for different types of costs and its impact on employees.

Cost Item Properties

The settlement method you decide to follow has different implications. For example, some companies tend to adopt an expense claim policy when their employees purchase work-related devices, such as a computer and mobile phone, and set in their policy a maximum reimbursement limit, for example, 3000 riyals. If the employee gets a device at a higher value, he will not be compensated for the full amount, and the device will be fully owned by the company.

But if the company follows a fixed allowance policy for the purchase of devices, the employee can buy a device with better specifications at a higher value, and the ownership of the device will be his/ hers. The employee may not have to eventually buy any device and the value of the allowance will be accounted for using his personal device for work.

With regard to devices in particular, there are other important aspects that must be considered, such as control systems and protection of data, which we will address in another article.

In terms of cost item properties, let us consider 2 of them:

What is the value of the expense?

It is difficult to estimate the actual expenses of a company when using the fixed allowances. How exactly were the allowances disbursed? Is the actual cost greater than the sum of allowances for a particular item or less? Companies often set the fixed allowance amount on the basis of the lowest estimated cost, which often results in employees paying the difference and asking for a reimbursement later. Here, the company has to work on both solutions together, ensuring that employees follow the expense claims policies.

What is the estimated amount of expenses?

Many business expenses are recurring periodically, whether daily or infrequently. Transportation expense is a daily low cost item that companies compensate by setting a fixed allowance. Should the allowance include all forms of transportation? Some jobs call for constant travel, but due to the many variables that affect the cost of travel, it is difficult to compensate for it with a fixed amount.

The rule is that the more frequent and low in value an expense is, the more a fixed allowance is suited for it.

Impact on employees

In addition to looking at the cost characteristics, it is important to consider the impact of a stressful process on your employees.

Timing of compensation payment

When the employee receives a fixed allowance, he receives the amount before the expense occurs, which is an important point for employees who are unable to cover costs from their own money. On the other hand, if the policy is to claim expenses, the employee will not receive payment until the expense is realized and the claim form is submitted. The timing of compensation payment depends on the size of the company, its policy, and how free the employee is to deliver and follow up on the claim, so the period may exceed one month or more. Therefore, it is natural for employees to prefer receiving an advance allowance, especially if the expense cost is high.

In a nutshell!

The nature of your company expenses is the main factor in determining the type of payment and reimbursement, and you will often find it unavoidable to adopt an employee expense policy. Therefore, developing this process to be on the level of efficiency of allowances in terms of processing time and speed of payment is the best option for any company.

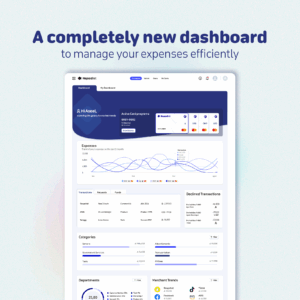

The best of both world? A fully automated expense management system.

Here is a summary of the comparison:

| Fixed Allowance | Expense Claim | ||

|---|---|---|---|

| Responsibility and Accountability | Unclear view of the actual exchange | A high degree of responsibility and transparency about the cost of actual expenses | |

| Transaction Process | Simplified or nonexistent | Takes a lot of time and effort | |

| Ease of processing claims | Advance Payment, no need to wait for reimbursement | reimbursement takes place after the expense has occurred and is subject to postponement |

Can you fully automate your expense management?

For more information about automating your expense management and avoiding all the challenges of expense claims, book your demo with NQOODLET here.

About NQOODLET

NQOODLET is a world class unified expenses management platform for SMEs who need to manage and streamline their expenses, through a full automated process that provides instant issuance to multiple payment corporate cards for team members and smart spending solution for expenses reports and reconciliations.