In recent years, the financial technology (fintech) industry has rapidly gained prominence within the financial sector. This emerging industry has significantly reshaped the traditional banking landscape that customers have been accustomed to for decades. As technology continues to transform and streamline conventional banking processes, customer preferences and expectations have evolved dramatically. Today, banks are no longer the sole providers of banking services. Fintech companies have become influential players, driving the financial sector toward greater innovation and efficiency.

How Fintech Companies Have Transformed the Financial Landscape?

In the past, banks held an undisputed dominance over the financial sector. However, with the rise of financial technology (fintech) companies, this long-standing balance of power has shifted.

Now, a pressing question emerges: Are fintechs competitors to traditional banks? To answer this question, 3 factors need to be considered to understand the relationship between banks and fintech companies:

First: Trust and Stability

Initially, banks had an advantage over fintech companies due to the trust factor and their long history of providing financial services. Banks have established brands that many people trust with their financial transactions. However, banks face a significant disadvantage when it comes to flexibility and innovation. They are subject to strict regulations and rely on outdated systems and processes, making it difficult to adopt new technologies and meet changing customer needs. In contrast, fintech companies are highly flexible, allowing them to adapt quickly to market changes and customer demands. Built entirely on modern technology, fintechs have gradually earned customer trust by offering reliable guarantees and security systems that ensure safe financial transactions. This has encouraged customers to adopt modern financial solutions without hesitation, giving fintech companies a share in customer preferences when seeking financial services backed by technology, security, and stability.

Secondly: Diversified Services

Until recently, banks did not offer a wide variety of services to facilitate financial transactions for their customers. However, with the emergence of fintech companies, which focus on meeting the needs of bank customers that were previously unmet, banks have started to provide the services their customers are looking for. Although this change is still somewhat slow, it is a response to the ongoing shifts in the financial market.

Fintech companies are credited with narrowing the gap between traditional banking services and the ever-changing needs of customers.

Third: Convenience and Flexibility

This is perhaps the most important factor in determining whether banks are in competition with fintech companies. When we take a look at the financial market and prioritize customer needs, we find that customers seek new and innovative solutions because they offer flexible facilities, streamlined processes, and the ability to move quickly in different directions. This is exactly what fintech companies provide.

Banks, on the other hand, are often large institutions with operations governed by a complex decision-making hierarchy, making it a significant challenge for them to keep up with the flexible facilities and processes offered by modern fintech companies to customers in the financial market.

By considering these factors, it can be said that fintechs and banks were initially competitors. However, how has this started to change recently?

Despite the competition between fintechs and banks, there are also opportunities for collaboration. With complementary strengths, they can create mutually beneficial partnerships by working together.

Both parties can benefit from such a partnership, but the banks stand to gain the most!

- New Services Without Significant Cost

By partnering with fintech companies, banks can provide innovative new services to their customers without the need to develop the technology independently, thereby avoiding the high costs of building services from scratch. This enables banks to stay competitive in a rapidly digitizing world.

- Accessing a New Customer Segment

Many bank customers fall into relatively older age groups, while younger customers often experiment with technology-based solutions, including financial services. This segment may prefer working with fintech companies for their financial needs. Through partnerships with fintechs, banks can access this younger demographic and offer tailored, innovative solutions, creating opportunities to attract these customers to traditional banking.

- Accelerating Digital Transformation in Banking Systems

Traditional banks have begun investing heavily in digital transformation and enhancing their digital platforms. However, competing with the agility of fintech companies can be challenging in the short term. Strategic partnerships that allow for knowledge exchange in the financial sector can help banks accelerate their own digital transformation efforts and keep pace with industry advancements.

Conclusion

Banks bring invaluable experience and expertise, while fintechs offer flexibility and innovation. By partnering and collaborating, we can deliver financial services that combine the best of both worlds: the stability and broad customer base of banks, along with the innovative, flexible solutions of fintechs.

We look forward to discussing potential collaboration and developing tailored solutions to elevate your services.

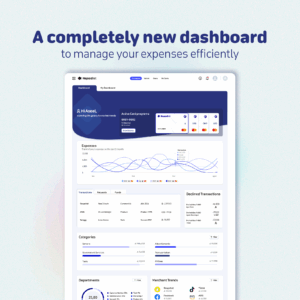

For any questions about Nqoodlet expense management solutions for SMEs, please feel free to schedule an appointment here ⭐️