Financial management in SaaS companies presents a unique set of complexities. From handling recurring revenue and forecasting cash flow to tracking key metrics like CAC, LTV, and churn, SaaS CFOs must go beyond traditional financial roles. Their responsibilities extend to strategic planning, growth management, and ensuring the business scales efficiently and sustainably.

This guide covers everything CFOs need to know about managing finances in a SaaS environment. Whether you’re leading a startup or an established SaaS company, you’ll gain practical insights to strengthen financial health, enhance performance, and drive long-term success.

Understanding SaaS Economics

SaaS companies operate on a fundamentally different business model compared to traditional software companies. The recurring revenue model, coupled with the importance of the customer retention and acquisition, creates a unique set of financial challenges and opportunities.

Key Aspects of SaaS Economics:

- Recurring Revenue Model: The backbone of SaaS businesses, where customers pay regularly for ongoing access to software.

- Cash Flow Management: Critical due to upfront costs and delayed revenue recognition.

- Product-Market Fit: Essential for sustainable growth and customer retention.

- Repeatable Sales Process: Necessary for scaling efficiently and predictably.

- Scalability: The ability to grow revenue faster than costs.

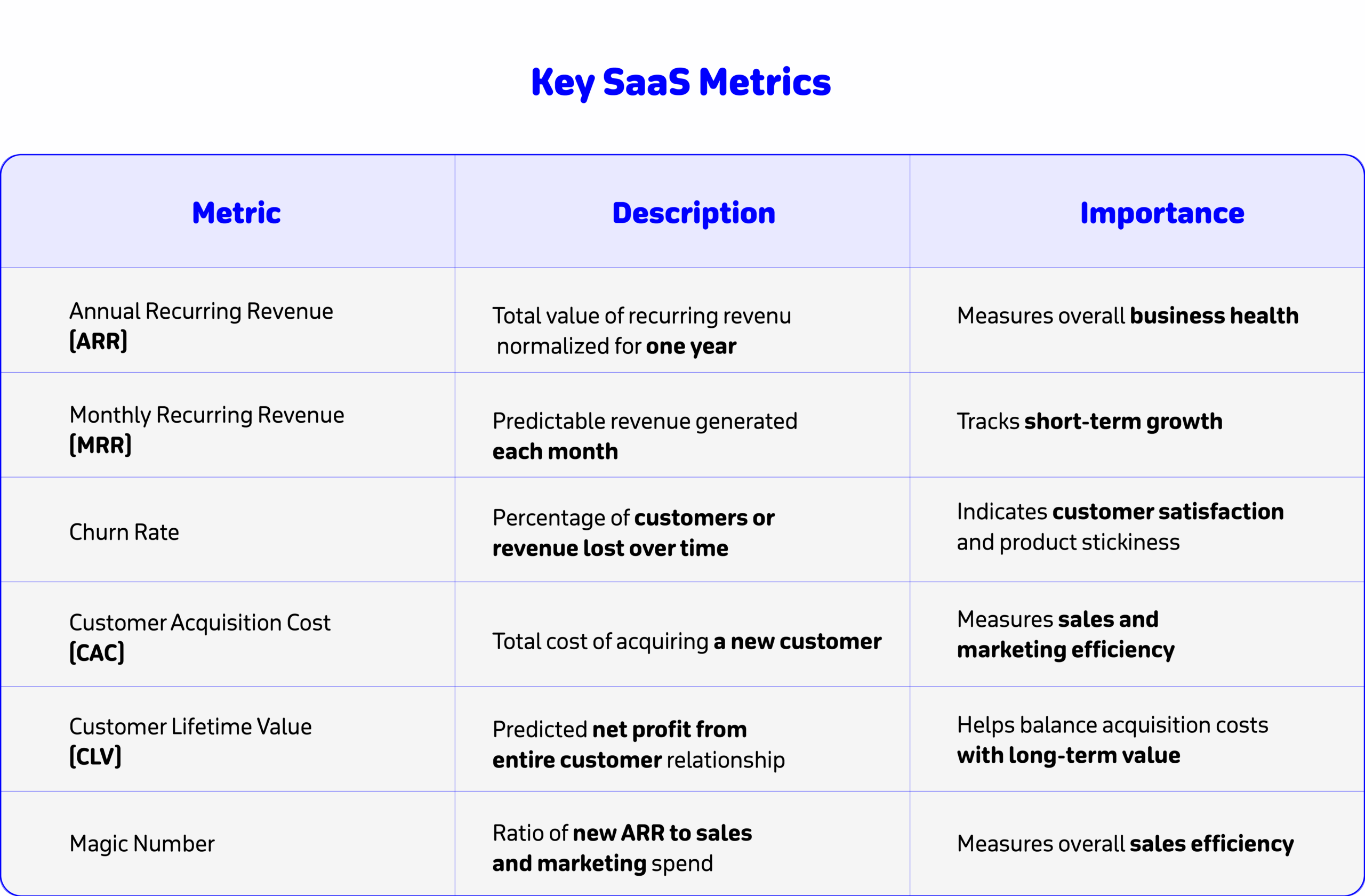

Key SaaS Metrics Every CFO Should Know

To manage finances effectively in a SaaS company, it’s important to track a few core metrics that reflect the health and growth of the business. Here’s a quick overview:

Annual Recurring Revenue (ARR): The total recurring revenue expected from customers over a 12-month period.

Monthly Recurring Revenue (MRR): The predictable revenue a company expects every month from subscriptions.

Churn Rate: The percentage of customers or revenue lost during a specific period—lower churn means better retention.

Customer Acquisition Cost (CAC): How much it costs, on average, to acquire a new customer.

Customer Lifetime Value (CLV): The total revenue a business expects from a customer over the entire relationship.

Magic Number: A metric used to measure sales efficiency—how much revenue growth is generated for every dollar spent on customer acquisition.

Understanding and regularly reviewing these metrics helps SaaS CFOs to:

- Benchmark against industry standards

- Analyze trends over time

- Make data-driven decisions

- Communicate performance to stakeholders

Financial Forecasting and Planning

Accurate financial forecasting is essential for SaaS companies—not just to project revenue, but also to manage expenses strategically. For CFOs, building a reliable forecast means understanding how both income and spending evolve as the business scales. Effective forecasting helps maintain healthy cash flow, support growth initiatives, and build investor confidence.

Key Components of SaaS Financial Forecasting:

- Revenue Forecasting: Estimate future revenue based on current MRR or ARR, growth trends, churn rate, and upsell potential.

- Expense Forecasting: Plan for all major cost drivers—including product development, cloud infrastructure, customer support, sales commissions, and marketing spend.

- Cash Flow Forecasting: Monitor when cash comes in and goes out to ensure your business stays liquid and avoids cash crunches.

- Scenario Planning: Build flexible models to account for best-case, worst-case, and most-likely financial outcomes.

- Budget Alignment: Ensure your expense forecasts align with strategic goals—whether it’s customer acquisition, team expansion, or product innovation.

Pro Tip: Pair revenue forecasts with cohort-based expense modeling. This allows you to better understand the cost of supporting each customer segment over time and optimize your unit economics.

SaaS CFO Dashboard

A well-designed CFO dashboard provides real-time visibility into key financial and operational metrics. This tool is essential for monitoring performance, identifying trends, and making timely decisions.

Elements of an Effective SaaS CFO Dashboard:

- Revenue Metrics: ARR, MRR, revenue growth rate

- Customer Metrics: Total customers, new customers, churn rate

- Sales and Marketing Metrics: CAC, CLV, Magic Number

- Cash Flow Metrics: Burn rate, runway, cash balance

- Operational Metrics: Gross margin, customer support costs

CFO’s Role in Fundraising for SaaS Companies

SaaS CFOs play a crucial role in securing funding to fuel growth. They must be adept at preparing financial statements, creating compelling financial models, and effectively communicating the company’s financial story to investors.

CFO’s Responsibilities in Fundraising:

- Financial Statement Preparation: Ensuring accurate and GAAP-compliant financial statements.

- Financial Modeling: Developing detailed models showcasing growth potential and unit economics.

- Investor Relations: Building and maintaining relationships with potential investors.

- Due Diligence Support: Providing necessary financial information during the investment process.

- Valuation Analysis: Determining appropriate company valuation for fundraising rounds.

Cash Management and Financial Operations

Effective cash management is critical for SaaS companies, especially during the early stages when they may be operating at a loss while building their customer base.

Key Areas of Focus:

- Bookkeeping and Accounting: Maintaining accurate financial records and ensuring compliance with accounting standards.

- Payroll and Expense Management: Optimizing personnel costs and controlling operational expenses.

- Working Capital Management: Managing accounts receivable, accounts payable, and inventory (if applicable) to optimize cash flow.

- Tax Planning and Compliance: Ensuring adherence to tax regulations and optimizing tax strategies.

Risk Management and Compliance

SaaS CFOs must identify, assess, and mitigate financial risks while ensuring compliance with relevant regulations.

Risk Management Strategies:

- Cybersecurity: Protecting sensitive financial and customer data.

- Regulatory Compliance: Adhering to data privacy laws (e.g., GDPR, CCPA) and industry-specific regulations.

- Foreign Exchange Risk: Managing currency fluctuations for international operations.

- Credit Risk: Assessing and managing customer credit risk.

The Evolving Role of the SaaS CFO

The responsibilities of a SaaS CFO evolve as the company progresses through different growth stages. Understanding these stages helps CFOs prioritize their focus and adapt their strategies accordingly.

Stage 1: Product/Market Fit

- Focus: Establishing basic financial systems and controls.

- Key Metrics: MRR, customer acquisition, and retention rates.

- Priorities: Seed funding, accurate financial reporting, validating product/market fit.

Stage 2: Building a Repeatable Sales Process

- Focus: Scaling financial systems and processes.

- Key Metrics: CAC, LTV, sales efficiency metrics.

- Priorities: Series A/B funding, achieving profitable unit economics, refining sales processes.

Stage 3: Scaling the Business

- Focus: Supporting rapid growth and preparing for potential exit.

- Key Metrics: ARR growth, sales efficiency, profitability.

- Priorities: Growth capital, improving operational efficiency, potential M&A activities.

Building a High-Performing Finance Team

As SaaS companies grow, CFOs must build and lead a finance team capable of supporting the organization’s evolving needs.

Key Roles in a SaaS Finance Team:

- Controller: Oversees accounting operations and financial reporting.

- FP&A Manager: Leads budgeting, forecasting, and financial analysis.

- Revenue Operations Manager: Manages billing, collections, and revenue recognition.

- Treasury Manager: Handles cash management and investment strategies.

Solving SaaS Finance Challenges with Smarter Expense Management

Throughout this guide, we’ve explored the critical responsibilities of SaaS CFOs—from tracking key metrics and forecasting revenue to managing cash flow and supporting strategic growth. But one area that consistently challenges finance teams is expense management. As SaaS companies grow, so do their operational costs, financial complexity, and the need for accurate, real-time visibility into spending.

This is where Nqoodlet steps in as a powerful ally for modern CFOs.

Built specifically for growing businesses, Nqoodlet offers an all-in-one financial platform that simplifies the way SaaS companies manage their finances. With smart corporate cards that enable real-time spend control, automated VAT filing and accounting, and comprehensive financial planning tools, finance teams can eliminate manual work and focus on strategic priorities. The platform also integrates with open banking for seamless cash flow visibility and provides access to a curated marketplace of high-quality services to support scale-up operations.

For SaaS CFOs looking to streamline financial operations, improve expense tracking, and drive smarter decision-making—Nqoodlet delivers a complete solution designed for the realities of modern SaaS finance.

Are you a CFO at a SaaS company looking for support with your financial operations?

Contact us today to schedule a demo and discover how Nqoodlet can benefit your business