Nqoodlet simplifies business expense management with its prepaid corporate cards and intuitive platform. Businesses can issue virtual or plastic cards, set spending limits, and gain real-time transaction visibility – all in one place. But what features do Nqoodlet clients love the most? Let’s dive into the top 3:

1. Instant Card Issuance

Imagine needing to get a new corporate credit card immediately. Without Nqoodlet, the traditional process can be slow and cumbersome. You’d likely need to fill out a request at the bank, wait for the card to be issued, and then activate it. Nqoodlet eliminates this wait time and admin requirements by allowing instant card issuance directly through the platform. This means you can get your new employee a virtual card immediately, allowing them to start making authorized purchases right away.

Pain Points Solved: Eliminates the need for lengthy bank applications and saves businesses money on additional card issuance fees while also streamlining expense processes to ensure timely access to company funds for employees.

2. USD Card Program

Operating internationally or having cross-border payments can mean racking up hidden fees due to currency exchange rates. Nqoodlet’s USD card program allows businesses to issue cards in US dollars, which can significantly reduce these charges. This is especially beneficial for businesses that subscribe to online services, many of which charge in USD.With Nqoodlet, businesses can avoid unnecessary currency fluctuations and get a clearer picture of their spending.

Pain Points Solved: Saves businesses money on foreign transaction fees, simplifies budgeting and expense tracking for online subscriptions, and provides greater transparency into overall spending.

3. Individual Card Transaction Statements

Managing multiple company cards can quickly become a headache, especially when trying to track spending for each card. Nqoodlet solves this problem with individual card account statements. This feature provides a detailed breakdown of each card’s activity separately, allowing businesses to easily see where and how company funds are being used.

Pain Points Solved: Improves expense tracking and accountability for individual cards, simplifies the reconciliation process, and helps identify any unauthorized or suspicious activity.

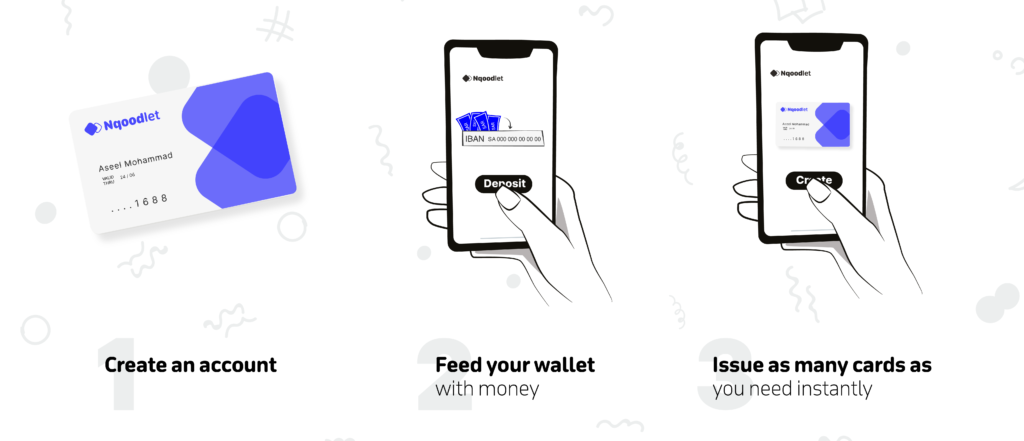

How to Start with Nqoodlet?

With Nqoodlet’s expense management platform, you have the power to issue your own cards effortlessly and immediately. Choose between SAR and USD cards, with competitive currency exchange fees tailored to your needs. Here’s all you need to do:

In a Nutshell…

Nqoodlet’s suite of features empowers businesses to streamline expense management, save money, and gain valuable insights into their spending habits. If you’re looking for a way to simplify your corporate payment process, Nqoodlet is a great option to consider.